APA Fundamental Payroll Certification FPC-Remote Exam Dumps: Updated Questions & Answers (March 2026)

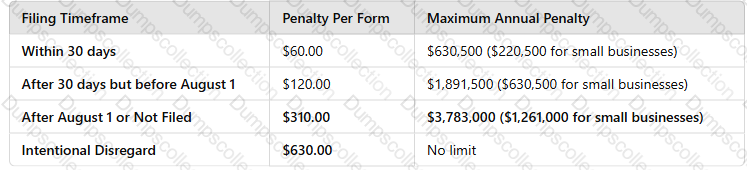

When an information return is filed after August 1st of the same year, the penalty amount per form is:

A mechanism which facilitates local tax withholding for an employee who is working abroad, but remains on the home country’s payroll system and is paid under a tax equalization plan, is called a(n):

Report backup withholding to the IRS using:

The FIRST action an employer should take when a natural disaster occurs is:

All of the following criteria are used to determine FMLA eligibility EXCEPT the number of:

Under the rules of constructive receipt, the employee is considered paid:

An employee has YTD wages in the amount of $250,000.00 and receives a $1,753.00 bonus payment. Using the optional flat rate method, calculate the federal income tax withholding from the bonus payment.

All of the following statements are correct regarding independent contractors EXCEPT that they:

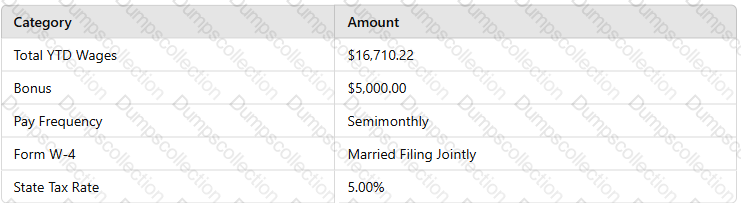

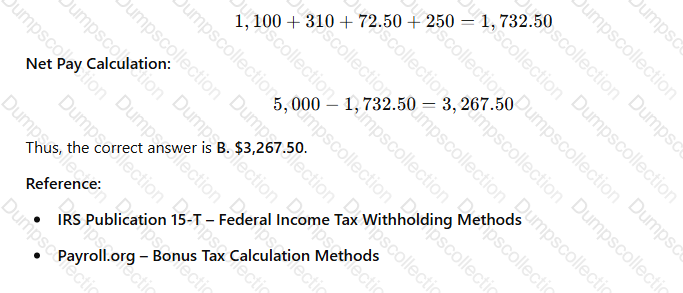

An exempt employee is being paid an annual discretionary bonus. The employee has submitted a 2020 W-4. Calculate the net pay based on the following information:

When an employee fails to cash a payroll check and the employer cannot locate the employee, the Payroll Department should:

A screenshot of a computer screen

AI-generated content may be incorrect.

A screenshot of a computer screen

AI-generated content may be incorrect. A white paper with black text

AI-generated content may be incorrect.

A white paper with black text

AI-generated content may be incorrect.