CIMA Fundamentals of financial accounting BA3 Exam Dumps: Updated Questions & Answers (March 2026)

Which THREE of the following are subsidiary bodies of the IFRS Foundation?

Refer to the exhibit.

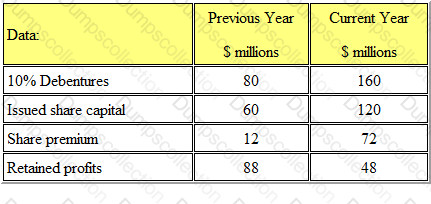

A business has the following capital and long-term liabilities:

It calculates its gearing ratio as the proportion of debt to total capital.

At the end of the current year, its gearing ratio, compared with that of the previous year, is:

Refer to the Exhibit.

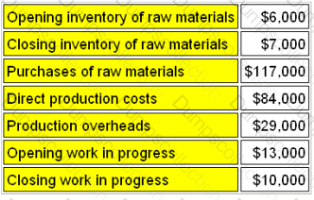

The following information is available for the period for AC Limited, a manufacturing company:

The factory cost of goods completed for the period was

The concept of stewardship refers to which ONE of the following?

At the beginning of the year, an organization’s non-current asset register showed a total net book value for fixed assets of £86,000. The nominal ledger showed non-current assets at cost of £120,000 and provision for depreciation of £39,000.

The disposal of a non-current asset for £10,000, at a profit of £2,000, had not been accounted for in the non-current asset register.

After correcting for this, the net book value shown in the ledger accounts would be

The balance on LMN's cash account at 31 December 20X6 is $108,000 (debit) On performing the monthly bank reconciliation the following is discovered.

• a payment of $2,000 made to a supplier has not yet appeared on the bank statement,

• an automated receipt from a customer for $5,000 has not yet been recorded in the cash book, and

• a pigment to a supplier of $1,500 was incorrectly recorded in the cash book as $1,050

The balance showing on the bank statement at 31 December 20X6 is

At the beginning of the year, a club's Membership Subscriptions account showed a debit balance of $500 and a credit balance of $225. During the following year, subscriptions received amounted to $12000.

At the end of the year, subscriptions paid in advance amounted to $200, and subscriptions in arrears, and expected to be collected, amounted to $150.

The amount to be transferred to the income and expenditure account for the year is

A business buys a new production line at a cost of £100,000. After using the line for one year a more advanced version of the line is marketed by the manufacturer. As a result the production line in operation has a market value of £ 50,000. The line is being depreciated straight line over five years.

The charge to the income statement for impairment of the production line will be

Refer to the Exhibit.

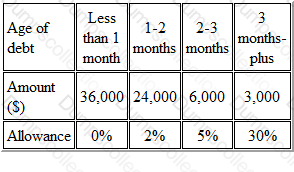

Berber Limited is preparing its year-end accounts and is reviewing the method used to estimate the allowance for receivables.

An aged receivables schedule shows the following position:

The company believes that the previous percentages used were not prudent enough and it has decided to increase the percentages on 2-3 months debt to 10% and on 3 months plus debt to 50%. The current allowance for receivables is $1,500.

What would be the effect on the income statement of the change in accounting policy

Refer to the Exhibit.

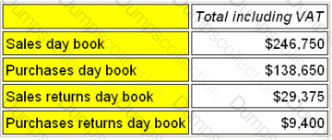

A company that is VAT-registered has the following transactions for the month of March.

All purchases were in respect of goods for resale and all items were subject to VAT at 17.5%.

Opening inventory was $16,200 and closing inventory was $18,400.

The movement on the VAT account for the period was: