CIMA Financial Strategy F3 Exam Dumps: Updated Questions & Answers (March 2026)

Company A plans to diversify by a cash acquisition of Company B an unlisted company in another country (Country B) which operates in a different industrial sector

Company A already manufactures its product in Country B and has a loan denominated in Country B's currency

Company A regularly suffers foreign exchange losses due to volatility in the exchange rate between the two countries' currencies in recent years.

Which THREE of the following appear to be be valid justifications of this diversification decision?

A company raised fixed rate bank finance together with an interest rate swap for the same term and same principal value to pay floating receive fixed rate interest on an annual basis.

Which THREE of the following statements are correct?

Using the CAPM, the expected return for a company is 11%. The market return is 8% and the risk free rate is 2%.

What does the beta factor used in this calculation indicate about the risk of the company?

Company J plans to acquire Company K, an unlisted company whose equity is to be valued using a P/E ratio approach.

A listed company has been identified which is very similar to Company K and which can be used as a proxy.

However, the growth prospects of Company K are higher than those of the proxy.

The Directors of Company J are aware that certain adjustments will be necessary to the proxy company's P/E ratio in order to obtain a more reliable valuation.

The following adjustments have been agreed:

• 20% due to Company K being unlisted.

• 15% to allow for the growth rate difference.

The total adjustment to the proxy p/e ratio is:

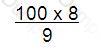

Company P is a large unlisted food-processing company.

Its current profit before interest and taxation is $4 million, which it expects to be maintainable in the future.

It has a $10 million long-term loan on which it pays interest of 10%.

Corporate tax is paid at the rate of 20%.

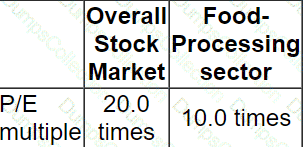

The following information on P/E multiples is available:

Which of the following is the best indication of the equity value of Company P?

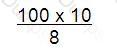

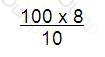

A company has:

• A price/earnings (P/E) ratio of 10.

• Earnings of $10 million.

• A market equity value of $100 million.

The directors forecast that the company's P/E ratio will fall to 8 and earnings fall to $9 million.

Which of the following calculations gives the best estimate of new company equity value in $ million following such a change?

A)

B)

C)

D)

Option A

Option B

Option C

Option D

A company’s statement of financial position includes non-current assets which are leased, the tax regime follows the accounting treatment.

Which cash flows should be discounted when evaluating the cost of lease finance?

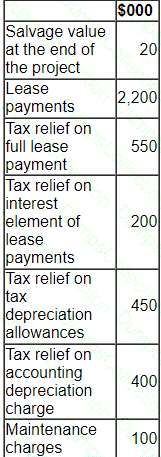

A project requires an initial outlay of $2 million which can be financed with either a bank loan or finance lease.

The company will be responsible for annual maintenance under either option.

The tax regime is:

• Tax depreciation allowances can be claimed on purchased assets.

• If leased using a finance lease, tax relief can be claimed on the interest element of the lease payments and also on the accounting depreciation charge.

The trainee management accountant has begun evaluating the lease versus buy decision and has produced the following data. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

Which THREE of the following are considered in detail in IFRS 7 Financial Instruments: Disclosures?

WW is a quoted manufacturing company. The Finance Director has addressed the shareholders during WW's annual general meeting-She has told the shareholders that WW raised equity during the year and used the funds to repay a large loan that was maturing, thereby reducing WW's gearing ratio

At the conclusion of the Finance Director's speech one of the shareholders complained that it had been foolish for WW to have used equity to repay debt The shareholder argued that the Modigliani and Miller model (with tax) offers proof that debt is cheaper than equity when companies pay tax on their profits.

Which THREE arguments could the Finance Director have used in response to the shareholder?