CIMA Risk Management P3 Exam Dumps: Updated Questions & Answers (March 2026)

S Doc is an out-of-hours service provided by a country's government. The service allows members of the public to call and speak to a nurse who can advise on medical situations which are not obviously emergencies. Depending on the situation the caller can be referred to the full emergency services, or be advised to go to Accident and Emergency at the nearest hospital. Alternatively, a callout from a general practitioner (GP) can be organised; the caller can be advised of where GP services are available; advice can be given over the phone; or a decision can be taken that no further action is required at least until normal services resume on the next working day.

There has been a suggestion that the nurses who take these calls could be replaced by suitably trained operatives who have available to them a specially designed expert system.

Which of the following are advantages of using an expert system instead of nurses?

Which of the following represents the greatest risk associated with introducing a system of post-completion audit for investment projects?

X has just set up a small public relations company. The company is growing last and already has eight employees. X"s accountant has said she needs to make sure she has good internal controls.

X disagrees and says that there are very few issues that could cause weaknesses in internal control in her type of business.

Which THREE of the following statements are correct?

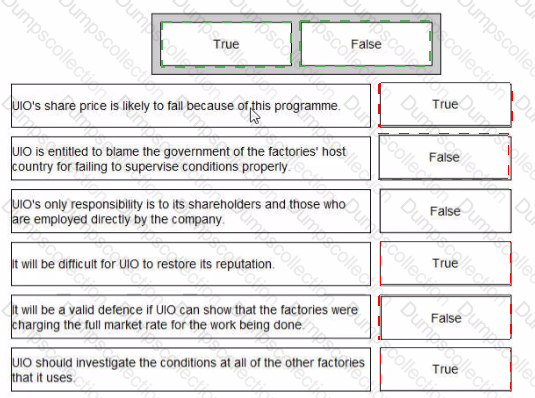

UIO designs clothes and pays third parties to manufacture them A recent television programme showed that two of the factories used by UIO were employing illegal immigrants whose status was used by the factory's owners to force them to work for low wages and in unpleasant and dangerous conditions. These factories were located in a developed country with strong labour laws

Classify each of the following statements as true or false:

A company is keen to avoid becoming a victim to malware. Which TWO of the following techniques would be valid responses to this threat?

You are the management accountant for YY a food manufacturing company with an annual sales revenue of $6 million

You discover that the production manager's records are inconsistent Raw materials purchased do not agree with the total recorded for transfers to production plus wastage There is an average shortfall of 2% of purchases

You have investigated and discovered that there are often errors made during manufacturing that results in food that is safe to eat but. because of visual flaws, cannot be sold

The production manager is supposed to scrap all such damaged products and write all such losses off as waste You have discovered however that he has been giving the damaged food to a charity that assists homeless people No records are made of such gifts in order to conceal the losses due to manufacturing errors

Which of the following actions should you take? Select ALL that apply

The treasurer of IOK is considering entering into a money market hedge in order to hedge a payable.

Which of the following might be valid explanations for the use of a money market hedge for this purpose?

M plc is an IT company that bids for large contracts to sell computer systems and also to service existing systems. M plc's senior management has always set budgets which are hard to achieve and have made no allowances for the recession.

The economy has improved and M plc's senior managers have made the budget even more optimistic. The budgeted sales target has been increased by 40%.

In the past, sales staff have not tried to achieve the budget sales because it was generally believed that the targets were impossible to reach.

M plc has recently appointed a new Sales Director who has decided that sales staff will be dismissed if they fail to meet sales targets for three successive months. He is also looking for higher sales margins than were achieved before.

What are the likely consequences of the new Sales Director's policy?

Which of the following is NOT a financial risk.

Division A of X plc produced the following results in the last financial year.

Net profit $200,000 Gross capital employed $1,000,000

For evaluation purposes all divisional assets are valued at original cost.

The division is considering a project that has a positive NPV, will increase annual net profit by $15,000, but will require average inventory levels to increase by $50,000 and non-current assets to increase by $50,000.

X plc imposes a 16% capital charge on its divisions. Given these circumstances, will the evaluation criteria of return on investment (ROI) and residual income (RI) motivate division A managers to accept the project?