PMI Portfolio Management Professional (PfMP) PfMP Exam Dumps: Updated Questions & Answers (February 2026)

Your company got recently acquired by another company and the strategic directions which your portfolio is based on have been changed. Which document do you, as a portfolio manager, change to reflect the portfolio new vision?

You are managing a complex portfolio with high risk levels due to emerging technological breakthroughs and a short benefit window to market your product. You know that managing risk is key to success and you are coaching your team on the same. A major risk has recently occurred and the risk owner came to you asking advise on how to report it. what would you advise her?

While defining the portfolio, the portfolio manager uses a set of evaluation criteria in order to generate a list of portfolio components for optimization and balancing. Which of the following is not an evaluation criteria?

A big strategic change occurred at the organization level and has impacted multiple portfolios in the organization including yours. The sponsor has asked you to analyze the change and update the needed documents. You managed this change and are currently updating the Portfolio Management Plan. Which of the following are part of this update

In identifying risks to then manage and control, as the portfolio manager you are consulting organizational process assets such as:

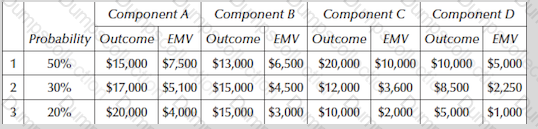

Assume you are putting together for the Portfolio Review Board several options for consideration of potential components and current components. You are using an approach with different probabilities to determine outcomes and EMV. Which of the following would you recommend realizing Components A and B are new, while C and D are in progress:

Following a recent portfolio health check, you noticed that your portfolio is not aligned with the strategic plan and actions should be taken to stop losing money. What should be your next course of action?

One of your team members who is particularly interested in becoming a portfolio manager has asked you what is the relation between the Portfolio roadmap and the Programs/Projects roadmaps? What should be your answer to him?

You are currently creating portfolio scenarios (what-if analysis) by reviewing components against prioritization criteria and using analysis techniques (e.g., options analysis, risk analysis, SWOT analysis, financial analysis). You are doing this in order to

Managing risk is key to the success of any initiative. Risk is considered to be inherent in any activity we do in project management and at any level. Risk is incorporated in all process groups as well. As a portfolio manager, how do you map the risk management elements to process groups?