Pegasystems Pega Certified Decisioning Consultant (PCDC) version 8.5 PEGAPCDC85V1 Exam Dumps: Updated Questions & Answers (March 2026)

To calculate the total number of customer responses of four actions in a group, you must use________________.

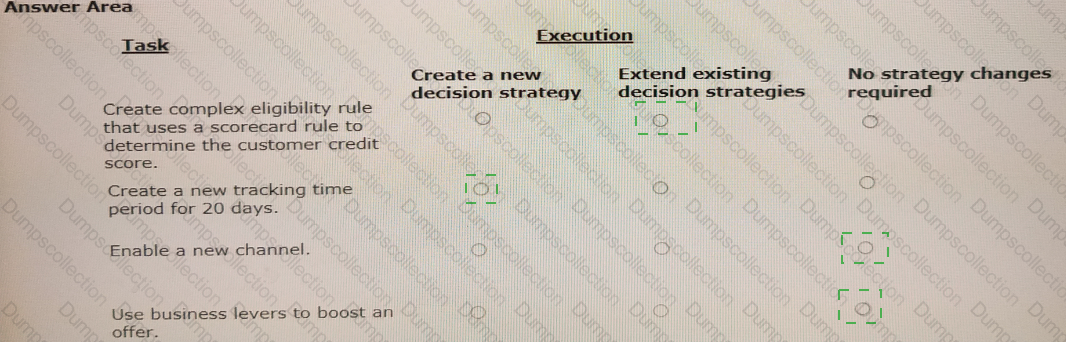

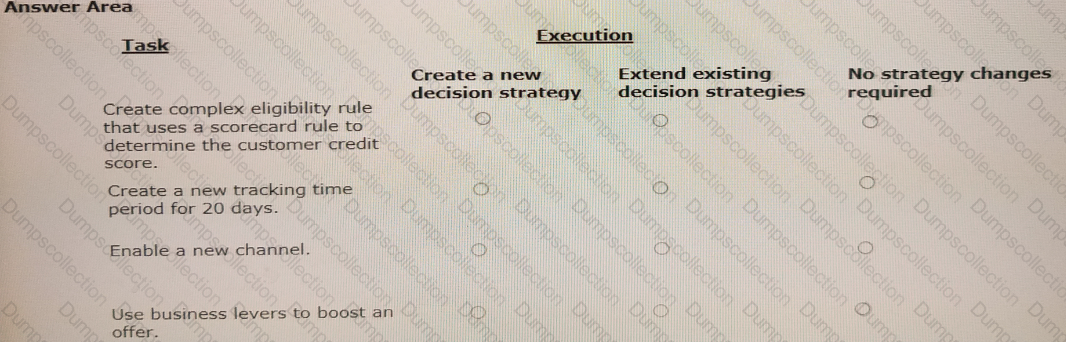

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub™. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

In Pega Customer Decision Hub™, the characteristics of an action are defined by using

U+ Bank has recently started using Pega Customer Decision Hub™ to display the first credit card offer, the Standard card, to every customer who logs in to their website.

Which three tasks do you need to perform to implement this requirement? (Choose Three)

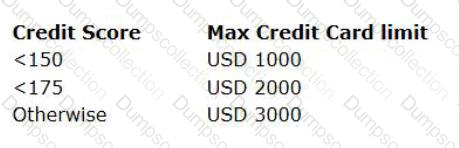

U+ Bank uses a Next-Best-Action decision strategy to automatically approve credit card limit changes requested by customers. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank:

The bank wants to change the threshold value for the USD 2000 credit limit from “<175” to “<200”.

As a Strategy Designer, how do you implement this change?

U+ Bank, a retail bank, uses the always-on outbound approach to send outbound messages on different channels such as email, SMS, and push notifications. There are a variety of action flow patterns in use to meet various business and channel integrations requirements.

Due to technical reasons, the bank wants to temporarily suspend sending outbound messages and instead write the selected customers and action details to a database table for later offline processing.

What is the most efficient way to meet this requirement?

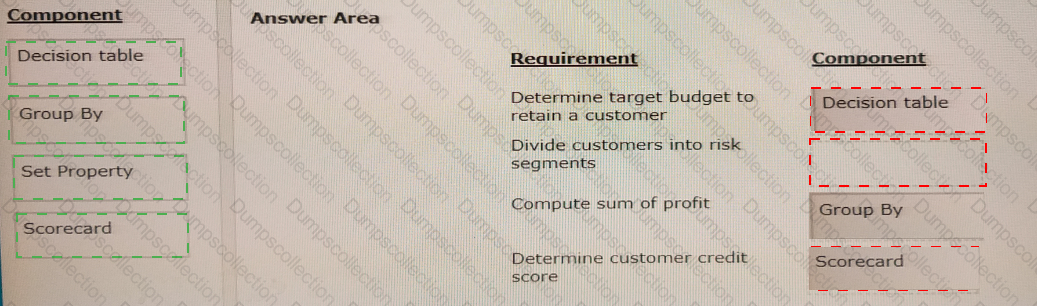

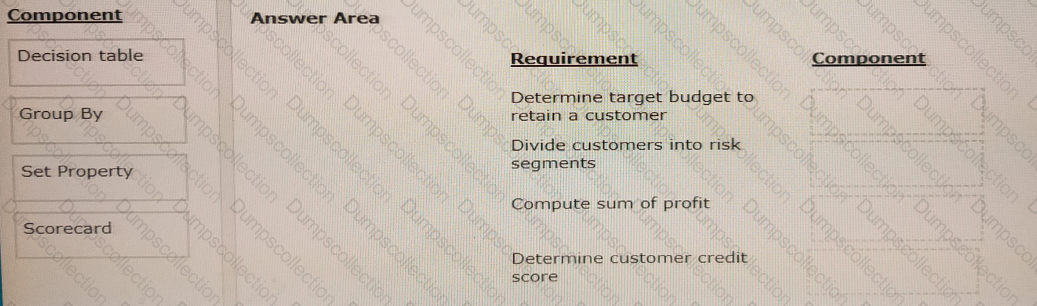

You are a strategy designer on a next-best-action project and are responsible for designing and implementing decision strategies.

Select each component on the left and drag it to the correct requirement on the right.

U+ Bank has launched a new credit card for all customers with a premium bank account. As a decisioning consultant, you need to create actions that involve the full customer life cycle: marketing, sales, and service.

Which two valid actions do you create? (Choose Two)

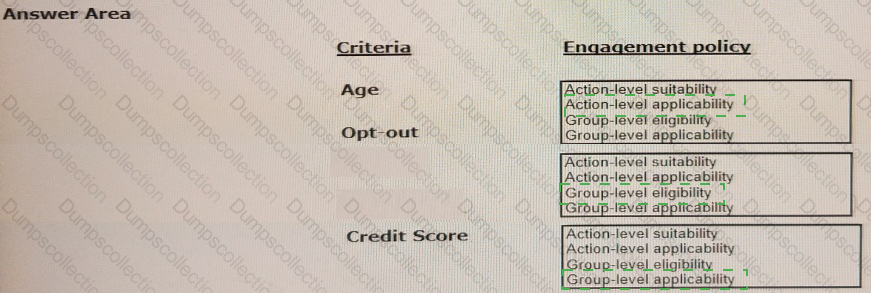

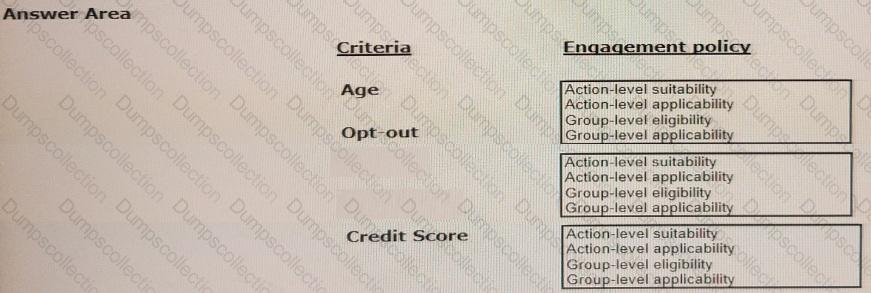

U+ Bank, a retail bank, has introduced a credit cards group with Gold card and Platinum card offers. The bank wants to present these two offers based on the following criteria:

1. For both cards, customers must be above the age of 18

2. Offer both cards only if the customer does not explicitly opt-out of any direct marketing for credit cards

3. Platinum card is suitable for customers with the Credit Score > 500

As a decisioning consultant, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

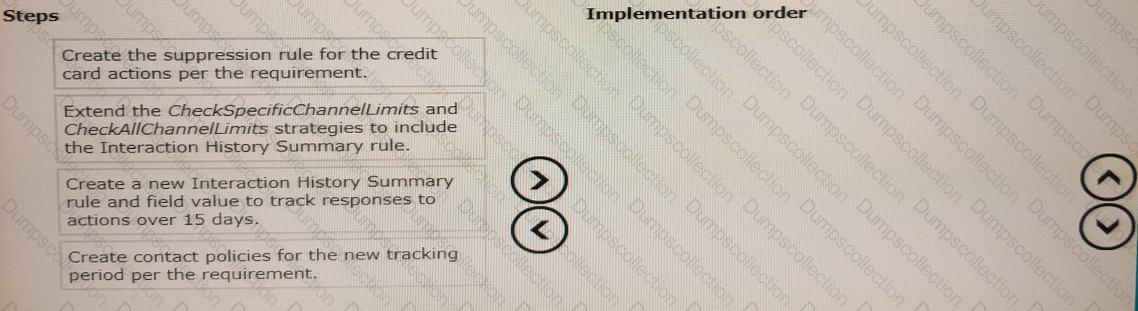

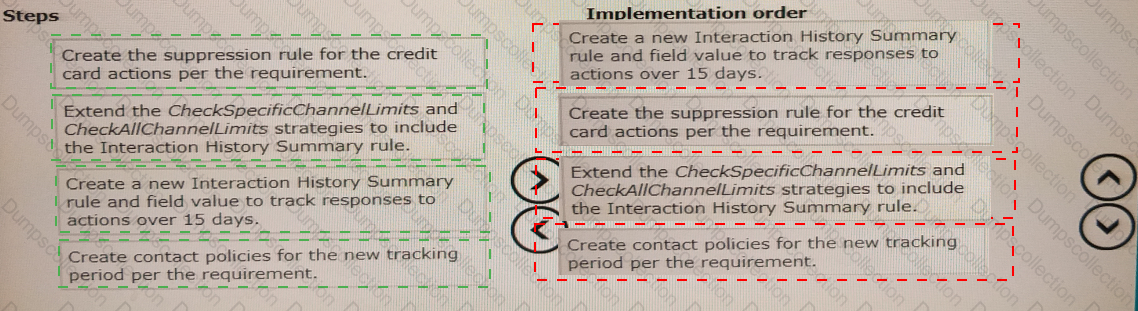

A financial institution wants to add a new tracking period to track its customers' response over 15 days in various channels. Once the response is tracked, they want to suppress the credit card actions if customers ignore it three times within 15 days.

Put the steps in the correct order to implement this task.