Pegasystems Certified Pega Decisioning Consultant (PCDC) 87V1 PEGAPCDC87V1 Exam Dumps: Updated Questions & Answers (March 2026)

Reference module: Sending offer emails

What is best practice for designing an action flow?

MyCo, a telecom company, introduced fiber optic service in the northern region of the country. They want to advertise this service on their website by using a banner and target the customers living in that area.

What do you need to configure in the Next-Best-Action Designer to implement this requirement?

Reference module: Essentials of always-on outbound

A bank has been running traditional marketing campaigns for many years. One such campaign sends an offer email to qualified customers on day 1. On day 3, it sends a reminder email to customers who haven't responded to the first email. On day 7, it sends a second reminder to customers who haven't responded to the first two emails. If you were to re-implement this requirement using the always-on outbound customer engagement paradigm, how would you approach this scenario?

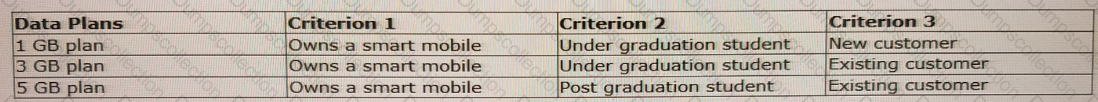

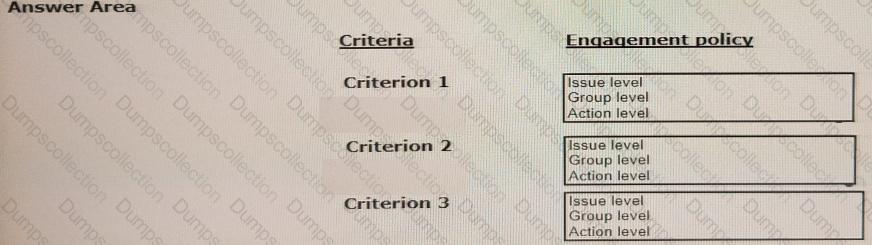

Myco, a telecom company, has come up with a new data plan group to suit its customers' needs. The below table lists the three data plan actions and the criteria a customer should satisfy to qualify for the offer.

How do you configure the engagement policies to implement this requirement?

MyCo, a telecom company, has a new requirement to track customer responses over a period of 20 days. What do you need to create to start tracking customer responses for the given period of time?

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer.

What is the next step that Pega Customer Decision Hub takes?

What is the name of the property that is automatically recomputed for each decision component?

U+ Bank is currently running outbound communications for home loan offers and credit cards. They have added five new actions to the Credit Cards group. They would like to enable these actions in the email channel. What are the two minimum configurations that must be made? (Choose Two)

U+ Bank, a retail bank, does not want to annoy customers by offering them a mortgage refinance option if they have less than 5% to pay off on their loan, although it would be profitable for the bank. Which engagement policy condition best suits this requirement?

U+ Bank a retail bank is cross-selling on the web by showing various credit card offers to its customers.

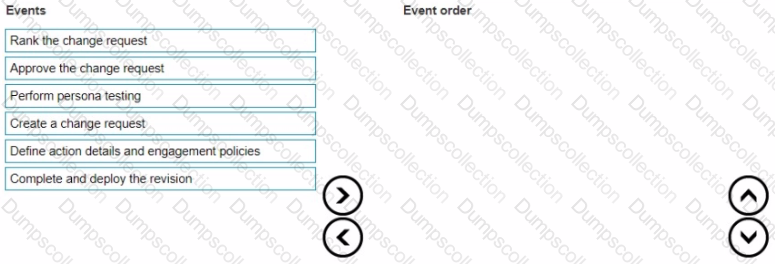

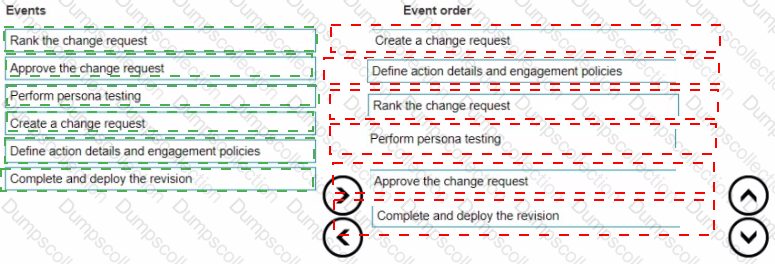

The bank wants to introduce a new offer in the Business Operations Environment Place the steps in the correct order of implementation.