Saylor Managerial Accounting (SAYA-0009) Exam BUS105 Exam Dumps: Updated Questions & Answers (February 2026)

Ladron Candies is analyzing sales and production data for the holiday boxes they produced last year. The company expected to use 0.10 direct labor hours to produce one box of specialty candy, and the variable overhead rate was $2.00 per hour. According to payroll records, the company paid for a total of 104,000 hours of direct labor wages. The actual variable overhead costs totaled $200,000. They sold 800,000 boxes of candy to retailers. What is the variable overhead efficiency variance?

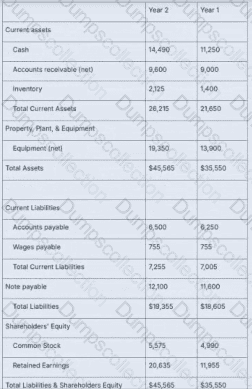

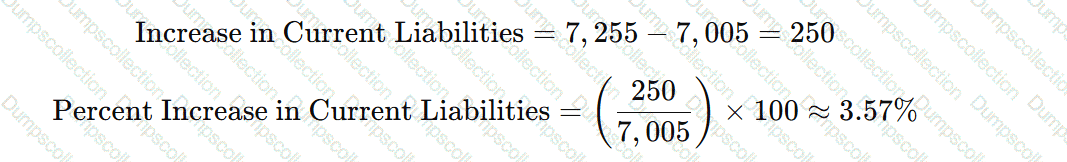

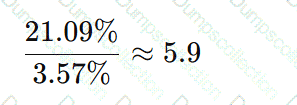

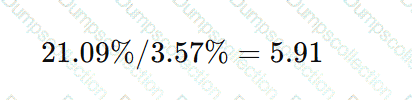

This is the balance sheet for Swinney Services. Using trend analysis, what does this information tell us about the trends for current assets and current liabilities?

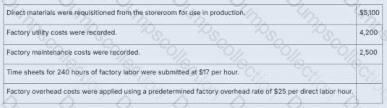

What is the balance in the manufacturing overhead account after these transactions were recorded, assuming the beginning balance was zero?

Now calculate the balance:

Manufacturing Overhead Balance = Actual Overhead – Applied Overhead

= $6,700 – $6,000 = $700 underapplied

Underapplied overhead → debit balance in Manufacturing Overhead account

Coffee Beanz, Inc. currently maintains decentralized operations. The CEO is evaluating whether the company should centralize their operations. Which of the following situations would make centralized operations more beneficial than decentralized?

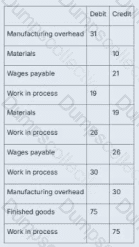

Wycliff Corporation manufactured Job #3 during the month of May. On May 29, 100% of the product was finished and sold on account for $150. These journal entries were recorded during production:

On May 31, Wycliff determined that the amount remaining in the manufacturing overhead account was immaterial and closed it out. What was the amount of gross profit before closing the manufacturing account, and what effect did closing the manufacturing account have on gross profit?

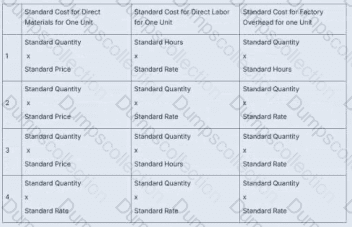

Which row correctly identifies the calculation to establish standard costs for direct materials, direct labor, and factory overhead?

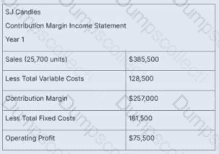

SJ Candles is performing a cost-volume-profit analysis to prepare for year 2. Fixed costs are expected to remain the same as year 1, but variable costs per unit are expected to increase by 10%. They plan to keep the same sales price but want to know what level of sales must be achieved in year 2 to maintain the same operating profit.

Wycliff Corp. had an immaterial credit balance of $1,250 in the manufacturing overhead account after $21,750 was applied to the WIP inventory account. To close the manufacturing overhead account at the end of the period, assuming no further transactions took place, what should Wycliff do?

Wycliff Corporation manufactures several different styles of bicycles. Managers appropriately record direct materials and direct labor into work-in-process accounts during production. To apply manufacturing overhead, managers consider cost pools for assembly and shipping to calculate a predetermined overhead rate for each department. Which of the following best describes the method used by Wycliff Corporation for allocating manufacturing overhead costs?

Thompson Dental is deciding between two lease options for a new copier. They anticipate making 22,500 copies spread evenly over the course of the year. Which of the following options should they choose if they want to save the most money on an annual basis, and how much money will they save?

Option 1: Monthly lease: $225, Included copies: 1,500/month, Additional copies: $0.15 per copy

Option 2: Monthly lease: $250, Included copies: 1,800/month, Additional copies: $0.02 per copy

A math equations with numbers and letters

AI-generated content may be incorrect.

A math equations with numbers and letters

AI-generated content may be incorrect. A math symbols with numbers and symbols

AI-generated content may be incorrect.

A math symbols with numbers and symbols

AI-generated content may be incorrect. A black numbers and a white background

AI-generated content may be incorrect.

A black numbers and a white background

AI-generated content may be incorrect.